Planning your dream Indian wedding? Here’s how to create a realistic budget, avoid debt, and still have a magical celebration you’ll remember forever.

💡 Introduction

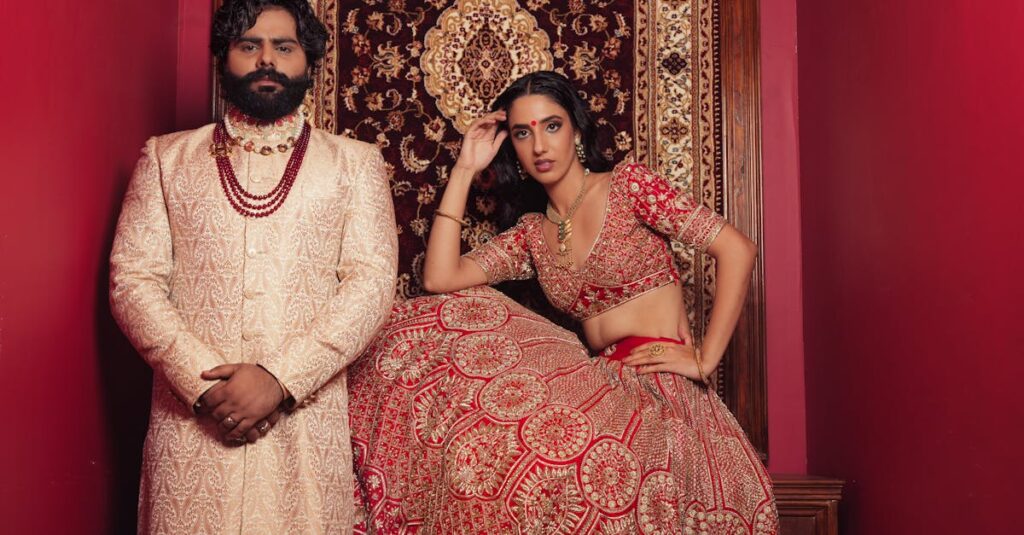

Weddings in India are often grand—lavish venues, outfits, functions, and guests.

But with that comes one of the biggest financial mistakes young couples make:

Starting married life with wedding debt.

Here’s the truth:

You can have a beautiful, personalized, unforgettable wedding without overspending—if you budget it smartly.

This guide will walk you through a step-by-step wedding budgeting strategy built for modern Indian couples.

1. 🧾 Know Your Total Wedding Budget First

Before booking anything, ask:

- What’s our total budget (from savings, parents, gifts)?

- Who is contributing what?

- Are we planning a single-day or multi-day function?

Average wedding budgets in India:

| Wedding Type | Budget Range |

| Intimate (50–100 guests) | ₹2 – ₹5 Lakhs |

| Mid-Range (100–300 guests) | ₹6 – ₹15 Lakhs |

| Luxury (300+ guests) | ₹20 Lakhs – ₹1 Cr+ |

2. 📊 Wedding Budget Breakdown by Category

Use this sample breakdown to allocate your funds:

| Category | % of Budget | Notes |

| Venue + Food | 40–50% | Book early for deals |

| Outfits + Jewelry | 15–20% | Buy during sale seasons |

| Makeup + Photography | 10–15% | Prioritize experienced pros |

| Décor + Event Mgmt | 10% | DIY options help cut costs |

| Invitations + Gifts | 5% | Consider digital invites |

| Misc. + Buffer | 5–10% | Unexpected costs always show up |

3. ✅ Build a Wedding Expense Tracker

Use a spreadsheet or app to monitor:

• Booking deposits

• Payment due dates

• Overruns vs. budget

• Gift registry credits (if any)

Free Tools:

Google Sheets, Notion, or wedding planning apps like WedMeGood

⸻

4. ✂️ Smart Ways to Save Without Compromising Style

• Choose weekday functions – venues are cheaper

• Limit guest list – more intimate = more budget per person

• Combine functions – e.g., mehendi + sangeet

• Rent instead of buying outfits

• Use natural lighting + outdoor venues to cut décor costs

⸻

5. 💳 Avoid These Wedding Finance Mistakes

• Relying on personal loans or credit cards

• Underestimating total cost by 10–20%

• Not having a miscellaneous buffer fund

• Not discussing money openly with families

• Delaying payments—can cost you higher rates later

⸻

6. 🎯 Plan for Post-Wedding Financial Health

• Don’t spend everything—keep 10–20% as post-wedding savings

• Start a married couple budget

• Create a joint emergency fund

• Set long-term goals (travel, home, kids) from Day 1

⸻

✅ Dream Wedding Budgeting Checklist

• Decide total available budget (your + family contributions)

• Break down by categories and priorities

• Track every payment with due dates

• Keep 5–10% cash flow for surprises

• Avoid debt, unless it’s 0% interest & small

• Align with your partner on key expenses

• Enjoy the process—money isn’t the only memory!

⸻

✅ Conclusion

A wedding is one day. Your marriage is for life.

Spend joyfully but wisely.

Create a celebration filled with laughter, meaning, and warmth—not regret and bills.

With smart planning and teamwork, your dream wedding can be both beautiful and financially responsible.